Table Of Content

However, your household income cannot exceed 115% of median household income to be eligible for this type of loan, so not everyone can qualify. If you can’t afford your down payment, you may qualify for down payment assistance. Down payment assistance programs help relieve many home buyers of this large upfront cost of buying a house. Many down payment assistance programs and grants also help cover closing costs, which may include a home appraisal fee, loan origination fee and homeowners insurance. In step with the housing market, the typical down payment has changed over time based on home prices, mortgage rates and other factors. Looking back to 2005, the lowest median down payment between now and then was a mere $1,000 in the fourth quarter of 2006.

Mortgage 101

Legal in 40 states, including California, commission rebates enable real estate brokers to provide a percentage of their commission back to new homeowners when they purchase a home. Not all brokers offer commission rebates, which is why buyers should ask about them when interviewing a potential buyer’s agent. Just remember that it’s possible to put less money down when buying a house. As we noted earlier, the minimum investment for a “standard” conventional loan can be as low as 3%. And the FHA program allows borrowers to put down as little as 3.5%. Eligible military members and veterans can use a VA loan to avoid the down payment altogether.

Rocket Mortgage

In general, you may qualify for a better interest rate with a higher down payment, which reduces the overall cost of your mortgage over time. Even a .25% reduction in your interest rate could save you thousands of dollars over the life of your loan. Most significantly, it can reduce the cost you pay to borrow money over the life of the loan. Reducing the amount you need to borrow, even by a little bit, will lower the amount you pay in interest over time, and it can lower your monthly payments as well. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Compare Types of Mortgages

Or use this mortgage calculator to estimate how much your mortgage payments would be depending on property value, down payment, interest rate, and repayment term. That is the minimum down required for a conventional home loan, a nongovernment loan and the kind favored by most buyers. Redfin, for example, shows a median sales price of $761,300 in California in spring of 2023. A 3% down payment would be $22,839; 10% down, $76,130; and 20% down, $152,260. If you want to start saving up for a home down payment, you'll want to open one of the best savings accounts available today.

How do down payment percentages affect private mortgage insurance?

In Los Angeles and Orange counties, the cap is $970,800, meaning you can buy a $1.2 million house with a 20% down payment. Every aspiring homeowner has different financial situations, and California buyers must consider what home loan aligns with their long-term goals. Borrowers who leave their job must pay the loan back at the due date of their next federal income tax date. A failure to do so incurs the same penalties levied against buyers who make a withdrawal from their 401(k). Bridgepoint Funding specializes in residential mortgages and serves borrowers and real estate agents throughout the entire state of California.

Build equity more quickly

If you can’t put 20 percent down, you’ll pay more for your loan, but that might be OK. Home values typically rise over time, so your investment can still pay off — especially when compared to paying rent which puts money in your landlord’s pocket and not your own. But your savings account isn’t big enough for even a 3% down payment.

hash-markMortgage Down Payment Requirements Based on Loan Programs

Rising rates are largely responsible for the sharp increase in mortgage payments. The average 30-year-fixed mortgage rate spiked to a five-month high of 7.4% this week, per Mortgage News Daily. The upshot is that anyone taking out a mortgage to buy a home is paying a lot more every month than in the past. The average homeowner is now forking out a record $2,800 just to cover their monthly payment, as soaring house prices and surging interest rates have made it costlier than ever to own a home. Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also rose this week, lifting the average rate to 6.44% from 6.39% last week.

About Chase

What is the Median Down Payment in America, by State? - Visual Capitalist

What is the Median Down Payment in America, by State?.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with a Chase Private Client Banker at your nearest Chase branch to learn about eligibility requirements and all available benefits. You do not have to make the customary down payment if you qualify for this sort of loan. However, your eligibility is contingent on a number of factors, including your duration of service in the military and the reason for your dismissal.

Research released Monday from real estate company Clever finds that with a 10% down payment, buyers need to earn nearly $120,000 to afford a median-priced home. Buyers seeking a conventional mortgage loan with low down payments will likely require PMI - more formally known as private mortgage insurance. PMI is required when a buyer requests a loan from a mortgage lender with a down payment of less than 20%. It can be challenging to save the money for a down payment on a house, especially if you’re a first-time homebuyer. The standard minimum down payments for various types of mortgages might not be as high as you think, however. Here’s what to know about the average down payment on a house for a first-time buyer.

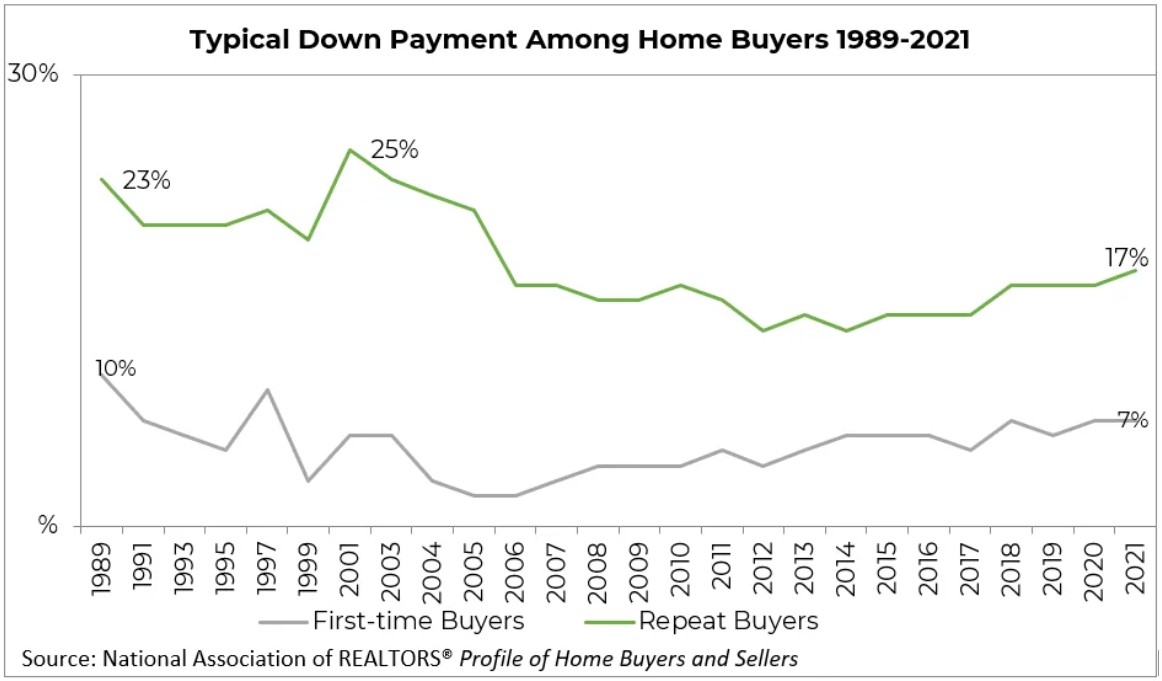

In its 2022 report, the National Association of Realtors (NAR) examined home purchase trends in the U.S. The NAR found the median down payment for all home buyers was 13 percent. But first-time buyers often prefer a smaller down payment and the average varies a lot by age group. Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent. The rate hikes have also raised monthly payments for car loans, credit cards, and other types of debt.

By investing this amount (or more) on a purchase, borrowers can avoid the extra cost of private mortgage insurance (PMI). That’s because PMI is usually required whenever the loan-to-value ratio rises above 80%. It's also possible to buy a home with no money down — typically through an alternative lender, like a credit union, or with government-backed mortgages like USDA and VA loans.

In fact, many people do put down less than 20% when buying a home. The median down payment for all US homebuyers in 2023 was 14% of the purchase price, according to The National Association of Realtors. The average down payment varies a great deal depending on the age of the buyer, as well. Ideally buyers would be able to put down at least 20% of the home price to avoid paying private mortgage insurance, but it’s not a requirement. With the median home price in 2023 at over $425,000, the average homebuyer would need $85,000 just for the down payment. A VA home loan is available for eligible military service members and veterans.

Lenders often provide a better rate to borrowers who have an LTV ratio of 80% or lower — in other words, at least a 20% down payment — because they consider them a better risk. There are first-time homebuyer programs and products that can allow for as little as 3% down on a home purchase. Buyers ages 23 to 31 put down a median of 8%, and those ages 32 to 41, 10%. The latest NAR Home Buyers and Sellers Generational Trends Report breaks down by age the percentage of a home that was financed by homebuyers in 2022. • Down payment assistance programs and gifts from family members can help with affordability.

FHA loans typically require a minimum down payment of 3.5%, although you may need a down payment of at least 10% if your credit score is between 500 and 579. These loans come with competitive rates and terms, yet they are only available for the purchase of a home you plan to live in. It’s possible to get a mortgage with a credit score below 620, particularly with an FHA loan, but you’ll need to put down a higher amount upfront — 10 percent. With other mortgages, though, a lower credit score likely won’t give you access to the most competitive rates, if you qualify. If your credit score is on the higher end, though, you may be eligible for a competitive rate even with a small down payment, as your strong creditworthiness could make you an attractive borrower to lenders. Lenders require homebuyers to make a down payment for most mortgages.

For example, you’ll typically need to put at least 3% down for a conventional loan or 3.5% down for an FHA loan, while USDA and VA loans don’t require a down payment. The best mortgage lenders will work with you to see which assistance programs you’re eligible for. You can also visit your state and local government housing agency departments for details.

No comments:

Post a Comment